Use of features of the taxation of small business in the USA for modern RUSSIA

1. Institutional approach at the level of submission of reports

The theoretical importance of institutional approach at the level of submission of reports is emphasized by Bochulya T.V., Bezverkhy K.V.20 In their opinion, "the possibility of use of institutional approach allows to construct such model which reflects information interrelations between subjects of managing and separate institutes, provides interaction of different types of the account and reporting".

From the practical point of view the institutional approach based on consciousness of the taxpayer is very important as untimely submission of reports by small business entities attracts considerable risks: risks of additional accrual of penalties, blocking of accounts of the taxpayer, and also risks of exit checks and special control of taxing authorities. Institutional approach at the level of submission of reports assumes increases in responsibility of taxpayers and timely submission of reports. A simple method of increase in organization of work of small business entities is the reminder to the taxpayer about need of submission of reports sent on an electronic box of the taxpayer, informing on correctness of filling of the reporting. Such practice, in particular, is used in the Czech Republic where notices of need of tax payment and collecting, messages on risks of penalties come to e-mail of small business entities, respectively the taxpayer can submit in due time the reporting, avoid penalties, optimize interaction with funds and taxing authority.

2. Institutional approach at the level of tax payment

Tax payment is very important component for any state. The purpose of the taxation is replenishment of the budget of the country and consequently, taxes allow to carry out functioning of state machinery. From the point of view of taxpayers institutional approach allows to reduce tax risks, to exclude charge of penalties, a penalty fee. Yakupov Z. S., investigating institutional approach in the taxation, notes that it "has to be characterized by aspiration to achievement of such level of mutual trust between the parties when not only sanctions, but also incentives against accurate and conscientious tax payment are urgent21".

Achievement of this purpose according to the author requires observance of the following conditions:

– existence of simple and clear system of the taxation;

– lack of collisions in the taxation;

– use of the principle of conscientiousness of the taxpayer as fundamental;

– conducting explanatory work with taxpayers, training;

– use risk – the focused approach to the taxation.

To accurate and conscientious tax payment treat incentives:

– tax concessions;

– granting the tax credit, delay and payment by installments of fiscal charges;

– a possibility of application of a zero rate on the profits tax, for example for the organizations which are engaged in educational and medical activity;

– possibility of application of the tax holidays for individual entrepreneurs;

– and other incentives in the taxation.

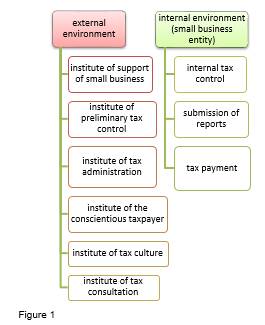

Thus, the author’s allocates several levels at which application of institutional approach is possible.

Levels of institutional approach

In general, the institutional approach based on development of separate institutes in the taxation will allow how to increase business activity and the number of small business entities, and will promote increase in a collecting of taxes and fees due to increase in consciousness of small business entities, "an exit from a shadow" of small enterprises.

2. USE OF FEATURES OF THE TAXATION OF SMALL BUSINESS IN THE USA

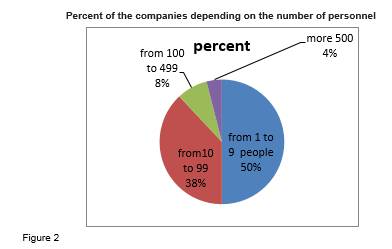

Unlike the Russian Federation small business takes an important place in economy of the United States of America. According to data of OECD more than 50% from all companies occupy small business entities22.

So, the taxation in the USA of business is carried out taking into account the following features:

1. Decrease in the effective tax rate of the corporate tax in the USA with a simultaneous growth of tax revenues in the budget

Конец ознакомительного фрагмента.

Текст предоставлен ООО «ЛитРес».

Прочитайте эту книгу целиком, купив полную легальную версию на ЛитРес.

Безопасно оплатить книгу можно банковской картой Visa, MasterCard, Maestro, со счета мобильного телефона, с платежного терминала, в салоне МТС или Связной, через PayPal, WebMoney, Яндекс.Деньги, QIWI Кошелек, бонусными картами или другим удобным Вам способом.

Примечания

1

The MIT dictionary of modern economics. 4-th ed. 1994. P. 209.

2

https://ru.wikipedia.org/wiki/%D0%98%D0%BD%D1%81%D1%82%D0%B8%D1%82%D1%83%D1%86%D0%B8%D0%BE%D0%BD%D0%B0%D0%BB%D0%B8%D0%B7%D0%BC

3

http://www.e-reading.by/bookreader.php/90061/Gigina_-_Veblen_Torsteiin.html

4

W. Hamilton. Institution. Encyclopedia of the Social Sciences. New York, 1932, v. VIII, p. 84.

5

D.R. Коммоns. History of an economic thought. Institutional economy, 2012, T.10, No. 3, page 69

6

Suleymanov M.M. Theoretical approaches to a research of tax federalism. Finance and credit, No. 40, p. 29-32

7

Gordeeva O. V. Small and average business: features of functioning and fiscal regulation//Taxes. 2012. N 22. Page 7 – 14; N 23. Page 10 – 18; N 24. Page 8 – 13; N 25. Page 7 – 12.

8

Matveeva O.Yu. Financial security of local self-government: institutional approach. Public administration. Electronic messenger. 2013. No. 36. Page 238-251.

9

9 Lomtatidze O. V., Tinyakova V. I. Institutional model of the financial market: problem aspects of improvement of system of regulation. Bulletin of the Volgograd state university. Series 3: Economy. Ecology. 2013.№ 2 (23). Page 165-172.

10

Movchan Yu. V. Influence assessment as institute of stability of development in rule-making of the European Union. Euroasian legal profession. 2014. No. 4 (11). Page 75-80.

11

Hafizova A.R. Tax administration in system of administration of the income of budgets Economic sciences. 2015. No. 127. Page 115-118.

12

Masur Yu.A. A tax factor in neoclassical and evolutionary models of economic growth. Messenger URFA. Series: Economy and management. 2009. No. 5. Page 19-31.

13

Sadchikov M.N. Legal culture in the sphere of the taxation as an indispensable condition of effective interaction between taxing authorities and nalogoobyazanny faces. Bulletin of the Perm university. N 2 (20). 2013..

14

Grigorieva E.N. Interrelation of sense of justice and legal culture of the taxpayer with fiscal function of the modern state//Messenger of the Perm university. Jurisprudence. 2012. N 3. Page 45 – 51.

15

Aytkhozhina G.S. Development of tax consultation as instrument of improvement of quality of the tax relations. Science about the person: humanitarian researches. 2012. No. 2 (10). Page 27-33.

16

http://khakassiya.mesi.ru/upload/iblock/170/17062f2d19c7d77826409879b39a29a2.pdf

17

Yakupov Z.S. Tax administration and directions of its improvement//Thematic release: etudes about taxes… Walks on Mira Nalogov with Arkady Bryzgalin / under the editorship of A. V. Bryzgalin//Taxes and a financial law. 2013. N 5. Page 146.

18

Kalinicheva R.V., Makarov N.N. Institutional approach to formation of internal system of tax control. Audit and financial analysis, No. 4, 2010.

19

Kakovkina T.V. System of internal control as means of identification of risks of the organization//International accounting. 2014. N 36. Page 37 – 47. .

20

Bochulya T.V., Bezverkhy K.V. The reporting in the polyvariant account for internal management and external regulation of economy//the International accounting. 2014. N 37. Page 51 – 63.

21

Yakupov Z.S. Tax administration and directions of its improvement//Thematic release: etudes about taxes… Walks on Mira Nalogov with Arkady Bryzgalin / under the editorship of A. V. Bryzgalin//Taxes and a financial law. 2013. N 5. Page 146.

22

http://www.oecd.org/cfe/leed/1918307.pdf

Вы ознакомились с фрагментом книги.

Для бесплатного чтения открыта только часть текста.

Приобретайте полный текст книги у нашего партнера:

Всего 10 форматов